Q-Exchange Blog

What is a Delaware Statutory Trust (DST)?

What is a Delaware Statutory Trust (DST)? A Complete Guide to Passive Real Estate and 1031 Tax Deferral

Introduction

A Delaware Statutory Trust (DST) is a powerful yet often underutilized tool for real estate investors seeking to defer capital gains taxes and generate passive income. Structured as a legally recognized entity under Delaware law, DSTs are primarily used in conjunction with Section 1031 exchanges, allowing investors to reinvest proceeds from the sale of investment property into institutional-quality real estate. In recent years, DSTs have gained traction among retiring landlords, busy professionals, and those planning intergenerational wealth transfers. This guide explores everything you need to know about DSTs—from how they work to their benefits, risks, and alternatives.

The Basics: What is a Delaware Statutory Trust (DST)?

Definition and Legal Framework

A Delaware Statutory Trust is a legal entity created under Delaware law that enables multiple investors to own fractional interests in real estate assets. It’s governed by a trust agreement and managed by a trustee or sponsor. DSTs are typically structured to comply with IRS Revenue Ruling 2004-86, which confirms that beneficial ownership in a DST qualifies as direct ownership of real estate for the purposes of a 1031 exchange.

Historical Context and IRS Recognition

The DST structure gained formal IRS recognition in 2004, establishing it as a valid replacement property vehicle under Section 1031. Prior to that, real estate syndications typically used Tenants-In-Common (TIC) structures, which had operational complexities and risk of IRS non-compliance. The DST solved many of these problems by offering a more passive, standardized investment model for fractional real estate ownership.

Role in 1031 Exchanges

One of the biggest advantages of DSTs is their eligibility as a replacement property in a 1031 exchange. This allows investors to sell appreciated real estate and reinvest the proceeds into a DST without triggering immediate capital gains tax. This makes DSTs especially appealing for those looking to exit active property management while maintaining tax deferral benefits.

How a DST is Structured

Trustee vs. Beneficial Owners

In a DST, investors are beneficial owners of the trust and not direct title holders. The title to the real estate is held by the DST itself, and the trust is managed by a trustee or sponsor, typically a professional real estate investment firm. Investors receive their pro-rata share of income, tax benefits, and appreciation based on their ownership percentage.

How Property Ownership Works in a DST

The DST acquires one or more income-generating properties—such as multifamily apartments, medical offices, industrial facilities, or retail centers. These properties are managed by the trustee, who handles all leasing, repairs, refinancing, and disposition activities. Investors have no management responsibilities, making it a true passive investment.

Management Responsibilities and Sponsor Role

The sponsor of the DST is responsible for all operational decisions, including tenant management, financial reporting, and eventual property sale. Investors must rely on the sponsor’s experience and track record, making due diligence critical when selecting a DST offering.

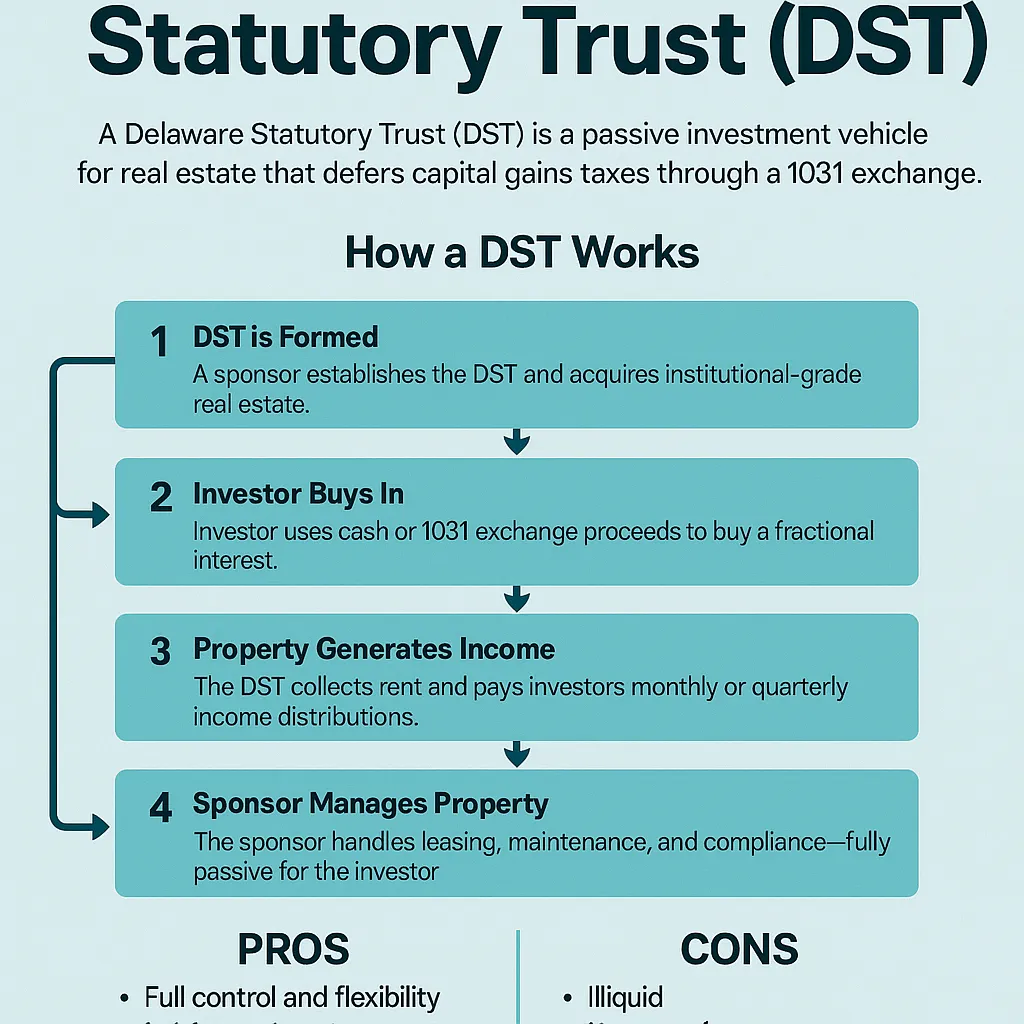

How a DST Works

The Investment Process

Investing in a DST typically begins with selecting an available offering, which is usually marketed through financial advisors or DST sponsors. Investors purchase a fractional interest in the trust, which in turn owns the real estate. This investment is considered a direct interest in real property for IRS purposes, making it suitable for use in a 1031 exchange. Minimum investment amounts typically start around $100,000, making DSTs accessible to a wide range of accredited investors.

Income Distribution to Investors

DSTs generate income from rental payments collected on the properties held by the trust. This income is distributed to investors on a regular basis—typically monthly or quarterly—based on their ownership percentage. The income is considered passive and reported to investors on a Schedule K-1 or 1099, depending on the structure.

Property Lifecycle: Acquisition, Management, Disposition

DSTs usually have a clearly defined investment lifecycle:

Acquisition Phase: The trust acquires one or more stabilized, income-producing properties.

Management Phase: The sponsor oversees all property operations, including leasing, maintenance, and cash flow optimization.

Disposition Phase: After a typical holding period of 5–10 years, the property is sold, and proceeds are distributed to investors—or used in another 1031 exchange.

Key Benefits of a Delaware Statutory Trust

1031 Exchange Eligibility

The primary appeal of a DST is its full compliance with Section 1031 of the Internal Revenue Code. Investors can defer capital gains taxes by reinvesting sale proceeds from appreciated real estate into a DST, satisfying the “like-kind” exchange requirement with minimal complexity.

Truly Passive Real Estate Investing

DSTs allow investors to enjoy the benefits of real estate ownership—like appreciation, rental income, and depreciation—without the headaches of property management. This makes them ideal for those retiring from active landlording or seeking truly hands-free income.

Access to Institutional-Grade Properties

DSTs typically invest in high-quality, professionally managed properties that would be cost-prohibitive for most individual investors. This includes Class A apartment buildings, medical centers, and large retail spaces in prime markets.

Fractional Ownership and Diversification

By investing in a DST, individuals can diversify their real estate holdings across multiple asset classes and locations with smaller capital outlays. This reduces risk and enhances portfolio stability.

No Property Management Responsibilities

All day-to-day decisions—leasing, maintenance, improvements—are handled by the sponsor or trustee. This appeals to investors who want reliable income without tenant hassles, property repairs, or time commitment.

Who Should Consider a DST?

Ideal Investor Profiles

DSTs are particularly suitable for:

Retirees transitioning away from active property management

Landlords seeking to exit without triggering capital gains taxes

Busy professionals wanting hands-free real estate exposure

Estate planners looking for a clean, transferable asset

Real Estate Investors Seeking to Exit Actively Managed Properties

Owners of rental homes, small apartment complexes, or commercial buildings who are tired of managing tenants or handling maintenance find DSTs a seamless way to maintain income while giving up responsibilities.

Retirees and Estate Planners

DSTs offer predictable income and are easily passed down to heirs. Because they qualify for a step-up in basis, beneficiaries may inherit the asset free of deferred capital gains, making DSTs a strong estate planning vehicle.

Tax Advantages of DSTs

Capital Gains Deferral Through 1031 Exchange

One of the most significant benefits of investing in a DST is the ability to defer capital gains taxes via a Section 1031 exchange. When an investor sells an appreciated investment property and reinvests the proceeds into a DST, they can defer paying taxes on the gains indefinitely, as long as the requirements of the 1031 exchange are met.

This allows investors to reallocate capital, increase income potential, and reposition assets without triggering a tax bill—making it a powerful wealth-building strategy.

Step-Up in Basis for Heirs

If the investor passes away while owning an interest in a DST, their heirs may receive a step-up in cost basis. This means the property’s tax basis resets to the current market value, effectively eliminating capital gains taxes on the deferred amount. This makes DSTs highly attractive for estate planning and intergenerational wealth transfers.

Depreciation Benefits

Because DSTs invest in income-producing real estate, they provide investors with pass-through depreciation deductions. These tax deductions can offset income received from the DST and reduce overall taxable income. While the depreciation is generally shared pro-rata among investors, it can significantly enhance the DST’s net after-tax yield.

Liquidity, Hold Periods, and Exit Strategies

Typical Holding Periods (5–10 Years)

DSTs are not short-term investments. Most DST offerings have a target holding period of 5 to 10 years, during which the properties are managed and stabilized. Investors should be prepared to keep their capital committed for the full term unless there is a major liquidity event.

Early Exit Limitations

Due to IRS restrictions and the nature of DST structures, early withdrawals are generally not allowed. Investors cannot sell their share back to the sponsor or redeem funds at will. This lack of liquidity is one of the primary risks of DSTs and should be considered when evaluating your investment goals.

Secondary Market Options

While rare, some secondary markets do exist for DST shares. However, finding a buyer can be difficult, and transactions are often subject to sponsor approval. In most cases, investors regain access to their capital only after the property is sold or when another 1031 exchange is initiated by the sponsor.

Risks and Considerations

Illiquidity

DST investments are illiquid by design. Unlike publicly traded real estate funds or REITs, you can’t sell your interest at any time. This means you must be confident you won’t need the invested capital until the DST completes its lifecycle.

Lack of Control

Once you invest in a DST, you surrender all operational control. The sponsor or trustee makes decisions regarding leasing, financing, repairs, and when to sell. While this provides simplicity and passivity, it also limits your ability to respond to market changes or property performance.

Market Risks and Property Performance

Like all real estate investments, DSTs are subject to market risks, including changes in interest rates, vacancy rates, and regional economic conditions. The performance of the property directly affects your income distributions and investment outcome.

Sponsor Quality and Due Diligence

Not all DST sponsors are created equal. It’s crucial to evaluate the sponsor’s track record, financial stability, and asset selection process. Transparency, reporting quality, and management experience can make or break the success of a DST investment.

How DSTs Compare to Other Investment Vehicles

DST vs. REITs (Real Estate Investment Trusts)

While both DSTs and REITs offer access to real estate and income potential, they differ in structure and tax benefits. A DST is a private offering used for 1031 exchanges and provides pass-through tax benefits like depreciation. Investors directly own a fractional interest in real property.

By contrast, a REIT is a publicly traded security. You buy shares in a company that owns property, but you don’t directly own real estate. REITs offer liquidity and diversification but do not qualify for 1031 exchange benefits.

DST vs. Direct Ownership of Real Estate

Direct property ownership allows full control over decisions, but it also brings full responsibility. You’ll manage tenants, repairs, insurance, and legal compliance. With a DST, all of this is handled by professionals, making it completely passive.

DSTs are ideal for those transitioning out of active property management but who still want the tax benefits of real estate ownership.

DST vs. Tenants-In-Common (TIC) Structures

Before DSTs were IRS-recognized, TICs were the go-to structure for fractional ownership in 1031 exchanges. TICs require unanimous decision-making among all owners, which can be cumbersome and lead to conflict. DSTs solve this by placing decision-making with the sponsor or trustee, creating a more scalable and passive structure.

Real-Life Case Study: Using a DST in a 1031 Exchange

Seller Profile and Situation

Sarah, a 65-year-old landlord in California, owned a fourplex for over 25 years. While it had appreciated significantly, she was exhausted by tenant issues and maintenance costs. Selling would trigger over $400,000 in capital gains taxes.

How the DST Helped Achieve Goals

Instead of selling outright, Sarah worked with a qualified intermediary to complete a 1031 exchange into a DST portfolio of multifamily and medical office buildings. She:

Deferred all her capital gains taxes.

Received monthly income.

Had no management duties.

Included the DST in her estate plan with a step-up in basis for her children.

For Sarah, the DST offered the ideal blend of passive income, tax strategy, and legacy planning.

Regulatory and Compliance Considerations

Revenue Ruling 2004-86

This IRS ruling provides the legal foundation for DSTs to qualify under 1031 exchange rules. As long as the DST follows specific operational limitations—such as no refinancing, no capital calls, and no new leases after closing—it is considered a direct ownership structure for tax purposes.

Qualified Intermediary (QI) Role

To comply with 1031 rules, investors must use a Qualified Intermediary (QI) to hold the proceeds from their sold property until they are reinvested into the DST. Any constructive receipt of funds can trigger taxes, so timing and compliance are essential.

SEC and Accredited Investor Requirements

Most DST offerings are private placements regulated under Reg D and require investors to be accredited. This typically means:

Income over $200,000/year (or $300,000 jointly), or

Net worth over $1 million (excluding primary residence)

Always review the Private Placement Memorandum (PPM) and consult your tax advisor before investing.

Frequently Asked Questions About DSTs

Can I Use a DST More Than Once?

Yes! You can reinvest from one DST into another using a 1031 exchange, continuing to defer capital gains taxes. Many investors “ladder” DSTs over time to build wealth passively.

Are DSTs Only for Real Estate?

Yes, DSTs are strictly used for real estate investment and are recognized under IRS guidelines specifically for this asset class. They are not applicable for deferring gains from stocks, crypto, or businesses.

How Do I Choose a Sponsor?

Choosing a DST sponsor is critical. Look for firms with:

A strong track record of full-cycle DSTs (from acquisition to successful sale)

Transparent reporting and fees

High occupancy and consistent cash flow

Ask for performance history and speak with your CPA or advisor to assess risk.

Can I Inherit a DST?

Yes. DSTs are inheritable, and your heirs may receive a step-up in basis, potentially eliminating deferred capital gains. This makes them a smart vehicle for legacy and estate planning.

Alternatives to Delaware Statutory Trusts

While DSTs are ideal for many investors, they are not the only tax-deferral strategy available. Here are a few notable alternatives:

1. 537 Installment Sale Trust (IST)

The 537 IST uses IRS Section 453 to defer capital gains taxes by placing sale proceeds into a trust and paying the seller via installment over time. Unlike DSTs, ISTs are not limited to real estate and provide:

High liquidity

Custom investment strategies

Income control

They’re great for those selling businesses, real estate, or appreciated assets who want more flexibility and broader use of proceeds.

For a full comparison of the 537 Installment Sale Trust and Delaware Statutory Trust, CLICK HERE.

2. Deferred Sales Trust (DST)

Not to be confused with Delaware Statutory Trusts, this type of DST is a tax-deferral strategy using a third-party trust. It’s often flagged by the IRS for compliance issues, so proceed with caution and proper legal review.

3. Qualified Opportunity Zones (QOZs)

Opportunity Zones offer tax deferral and potential elimination of gains if the investment is held long enough. However, these zones carry higher risk and longer hold periods.

4. Direct Real Estate with Property Managers

If you prefer more control and tangible ownership, hiring a professional property manager may help reduce your workload while retaining active ownership. However, you’ll still be responsible for taxes and strategic decisions.

Conclusion

A Delaware Statutory Trust (DST) offers a compelling solution for investors seeking to defer taxes, generate passive income, and simplify real estate ownership. Its IRS-approved structure, hands-off management, and estate planning benefits make it a favorite among retirees and long-time landlords.

However, it’s not without trade-offs. DSTs are illiquid, investor control is limited, and success often depends on sponsor performance. That’s why it’s crucial to align your strategy with your long-term goals.

If you’re looking for flexibility across different asset types, want more control over your funds, or plan to exit real estate entirely, alternatives like the 537 Installment Sale Trust may offer a better fit.

Ready to Start your Tax-Deferral Journey?

Schedule a 15-minute phone call for further questions or getting started.

Nothing on this site should be interpreted to state or imply that past results are an indication of future performance. This site does not constitute a complete description of our investment services and is for informational purposes only. It is in no way a solicitation or an offer to sell insurance, annuities, securities or investment advisory services except, where applicable, in states where we are registered or where an exemption or exclusion from such registration or licensing exists. Information throughout this internet site, whether stock quotes, charts, articles, or any other statements regarding market or other financial information, is obtained from sources which we, and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Neither our information providers nor we shall be liable for any errors or inaccuracies, regardless of cause, or the lack of timeliness of, or for any delay or interruption in the transmission thereof to the user. All investments involve risk, including foreign currency exchange rates, political risks, different methods of accounting and financial reporting, and foreign taxes.