1031 Exchange with a Built-In Safety Net

If your 1031 falls through or only partially qualifies, we keep your capital gains deferred and your plan on track, before deadlines hit.

Get Started

Get Started

Ready to start a 1031 exchange?

Q-1031 Exchange offers 1031 exchange accommodation and alternative tax-deferral options for a primary residence, business, investment property, or other highly-appreciated assets. Read more about how our solutions and experience of over 3800 transactions may help.

Ready to start a 1031 exchange?

Q-Exchange offers 1031 exchange accommodation and alternative tax-deferring options for a primary residence, business, investment property, or other highly-appreciated assets. Read more about how our cost-effective solutions may help your situation.

LIVE 537 IST / 1031 Exchange Q&A

Every Friday @ 8:30AM PST

IRC §1031 Exchange

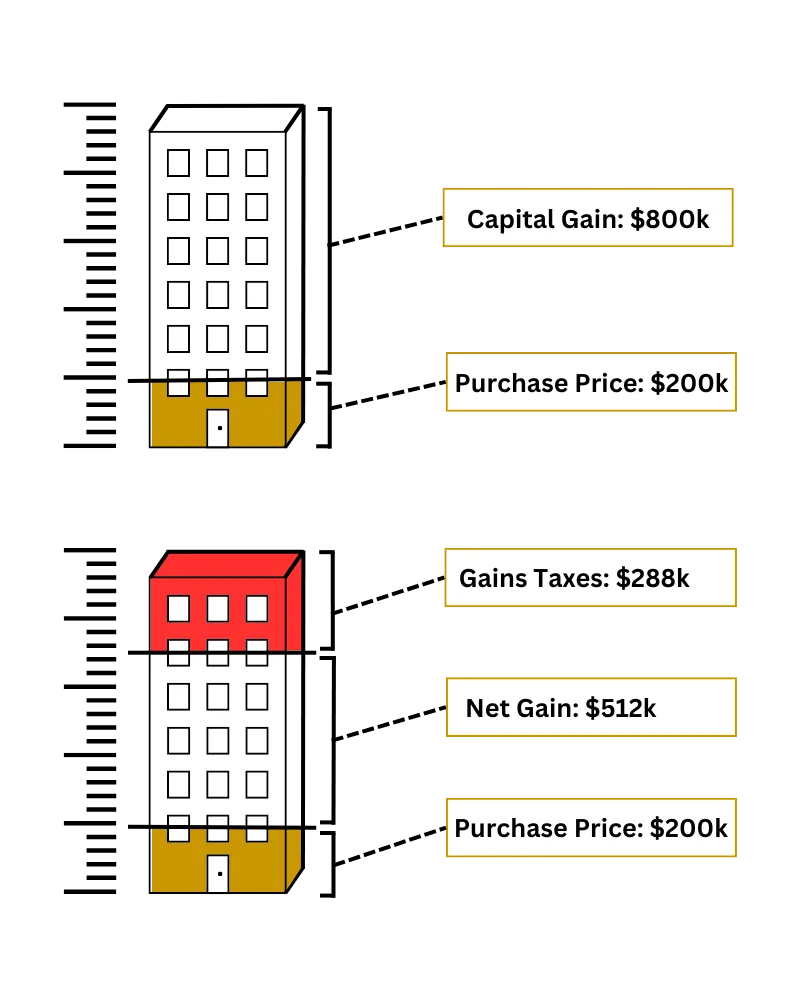

Also known as a like-kind exchange, allows investors to defer paying capital gains taxes on an investment property. This strategy enables real estate investors to leverage their assets to increase and diversify their real estate investment portfolios without the immediate capital gains tax burden.

By adhering to the specific rules and timelines set by the IRS, investors can effectively roll over gains from one property to another, fostering growth and flexibility in their real estate endeavors.

1 Minute Video

§1031 Exchange with a Safety Net

Many 1031 Exchanges either fail (~20%) or partially fail (~40%)

due to either not following the guidelines or timelines or the strict rules governing 1031 Exchanges. This can cost the exchanger (you) hundreds of thousands of dollars in capital gains tax.

Here at Q-1031 Exchange Solutions, we plan ahead with a 'safety net' option that can defer your capital gains. Our most popular safety net option is the 537 Installment Sale Trust (537 IST).

Pricing

1031 Exchange with a Safety Net Attached

Sell your existing property first, buy a replacement property second.

Starker Exchange or Deferred Exchange

$799

Multiple Safety Nets Attached

Unlimited Guidance & Support through any transaction

Capital Gains Tax Plan and post-sale income tax plan

Additional Financial Consulting for Future and Current Taxes

Why Use Q-1031 Exchange Services?

Additional Tax-Deferral Solutions

Improved Cash Flow Plans

Portfolio Diversification Plans

Deferring Taxes (up to 35 to 40% of the gain)

Estate Planning For Heirs

Over 3800 Transactions mediated

Post-Sale Tax Planning

Capital Gain Safety Nets For Every Transaction

Know someone that needs an exchange?

Refer a client and get $200!

We’ll send you a referral agreement to sign electronically. After, any introduction will be tied to your name. Once their exchange is complete, you'll receive your referral compensation!

*We offer larger compensation for affiliate partners that present our services to their audience. We will make a custom digital page for you.

LIVE 537 IST / 1031 Exchange Q&A

Every Friday @ 8:30AM PST

1031 Exchange FAQ

What is a Section 1031 Exchange?

A 1031 Exchange, also known as a like-kind exchange, is a tax-deferral strategy under Section 1031 of the Internal Revenue Code (IRC). It allows real estate investors to defer capital gains taxes on the sale of investment properties by reinvesting the proceeds into similar, or like-kind, properties.

How does a 1031 Exchange work?

In a 1031 Exchange, the investor sells an investment property and uses the proceeds to purchase another like-kind property. The process involves a qualified intermediary who holds the funds from the sale and facilitates the purchase of the new property. This must be done within specific timeframes to qualify for tax deferral.

What are the time limits for completing a 1031 Exchange?

The 1031 Exchange process has two critical deadlines: the identification period and the exchange period. The identification period requires the investor to identify potential replacement properties within 45 days of selling the original property. The exchange period requires the purchase of the new property to be completed within 180 days from the sale.

What qualifies as like-kind property in a 1031 Exchange?

Like-kind property refers to real estate that is of the same nature, character, or class. For example, an investor can exchange an apartment building for a commercial office space or raw land for a rental property. The properties must be held for investment or business purposes.

Can a 1031 Exchange be used for personal property?

No, the Tax Cuts and Jobs Act of 2017 limited 1031 Exchanges to real property only. Personal property, such as equipment, vehicles, or artwork, no longer qualifies for a 1031 Exchange. We offer other methods to defer capital gains taxes for these assets.

What are the benefits of a 1031 Exchange?

The primary benefit of a 1031 Exchange is the deferral of capital gains taxes, which allows investors to reinvest the full proceeds from the sale into new investment properties. This deferral can result in significant tax savings and increased investment capital.

Are there any risks or drawbacks to a 1031 Exchange?

While a 1031 Exchange offers tax benefits, it also comes with risks. These include the strict timeframes for identifying and purchasing replacement properties, potential challenges in finding suitable like-kind properties, and the complexity of the exchange process. Consulting with a tax advisor and a qualified intermediary is crucial. We can assist you with this.

What is a reverse 1031 Exchange?

A reverse 1031 Exchange allows investors to purchase the replacement property before selling the original property. This can be beneficial in competitive markets where finding a suitable replacement property is challenging. The process is more complex and requires the use of an Exchange Accommodation Titleholder (EAT) to hold the replacement property until the original property is sold. We can assist you with this.

Can you convert a 1031 Exchange property into a primary residence?

Yes, it is possible to convert a 1031 Exchange property into a primary residence. However, specific holding requirements must be met to avoid immediate tax consequences. The property must be rented out for a minimum of two years, and the conversion should be gradual to ensure compliance with IRS rules. We can assist you with this.

How do I choose a qualified intermediary for a 1031 Exchange?

A qualified intermediary (QI) is a neutral third party that facilitates the 1031 Exchange process. When choosing a QI, look for experience, reputation, and understanding of the latest IRS regulations. Ensure they have the financial stability and insurance coverage to protect your funds throughout the exchange. Here at Q-1031.com, we offer backup plans, a 'safety net', to protect you in case your 1031 exchange fails.

What are the most common mistakes to avoid in a 1031 Exchange?

Common mistakes include missing the 45-day identification deadline, failing to complete the exchange within 180 days, improperly identifying replacement properties, and using proceeds from the sale for non-qualified purposes. Working with experienced professionals can help avoid these pitfalls.

How does a 1031 Exchange work?

In a 1031 Exchange, the investor sells an investment property and uses the proceeds to purchase another like-kind property. The process involves a qualified intermediary who holds the funds from the sale and facilitates the purchase of the new property. This must be done within specific timeframes to qualify for tax deferral.

Ready to Start your Tax-Deferral Journey?

Schedule a 15-minute phone call for further questions or getting started.

Nothing on this site should be interpreted to state or imply that past results are an indication of future performance. This site does not constitute a complete description of our investment services and is for informational purposes only. It is in no way a solicitation or an offer to sell insurance, annuities, securities or investment advisory services except, where applicable, in states where we are registered or where an exemption or exclusion from such registration or licensing exists. Information throughout this internet site, whether stock quotes, charts, articles, or any other statements regarding market or other financial information, is obtained from sources which we, and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Neither our information providers nor we shall be liable for any errors or inaccuracies, regardless of cause, or the lack of timeliness of, or for any delay or interruption in the transmission thereof to the user. All investments involve risk, including foreign currency exchange rates, political risks, different methods of accounting and financial reporting, and foreign taxes.